Businesses often make the mistake of trying to sell to everyone. Are you guilty of this?

Why is this a mistake? Well, if you try to please everyone you end up delighting no-one. This is why best-in-class marketers work with best-practice segmentations. And targeting the biggest group is not often the best strategy. In fact it rarely is. Read on to find out why.

Your brand needs to appeal to a group of customers who are looking for the solution you are offering. This means that you need to make a choice of who to target amongst all category users. Making a choice implies that you will have to ignore some category users who you could perhaps attract. This seems counter-intuitive and makes many marketers scared. Does it scare you not to try and go after everyone?

It certainly worries many marketers and yet it’s the only way to sell more. Although this may not sound like common sense at first, segmentation actually ensures that you have the best possible chance to satisfy the needs of your targeted customers. Once you are satisfied with your results, you can always go after secondary target groups.

But let’s start at the beginning with the essentials of segmentation.

Where to start

When deciding who to target, most companies conduct some sort of analysis. This can be as simple as identifying your users by what you observe, such as young men, older housewives, or mothers of large families. And although these are easy to articulate, you are working with demographics, something every other brand can do as well. It also has the weakness of not truly understanding why your customers are choosing your brand – or not – over competition.

It therefore makes much more sense, to move on to a more sophisticated segmentation, just as soon as you can. Why? Because it is far more powerful. For example, rather than appealing to “young men”, targeting “those who value freedom and are looking for brands that can provide or suggest this dream” will immediately provide a clearer image of the group. Even if the majority of the segment are young men, the description is far more actionable. Do you see why?

Providing a detailed description of your target customers will always have the advantage of making engaging them that mush easier, because you will be speaking “their language.”

Types of segmentation

I mentioned above that you can simply use demographics to segment all category users. But I also alluded to the fact that it is not very distinctive, nor competitive. The sooner you can run a more complex segmentation the better.

The first thing to know about the essentials of segmentation is that there are five main types:

Firmagraphics: This is the most basic and is usually how the industry separates the different types of products and services. For example alcoholic versus non-alcoholic beverages, or still and sparkling, or bottles versus cans.

The consumers of the different types of beverages are easy to identify since the products they buy are too. As the grouping is based on the consumers of the different products, this is not a very useful segmentation for marketing, since consumers can appear in more than one segment. And as you will see below, one of the criteria of a good segmentation is that customers can only appear in one segment. However, product segmentations are useful for operations, sales and retail.

Demographics: As already discussed in an earlier post called “The 3 Rules of Effective Targeting”, the deeper your understanding of your target customer is, the more likely it is to provide you with a competitive advantage. I think the example I mentioned at the beginning makes this crystal clear, no?

Geographics: Included here are all the possible descriptions relating to your customers’ geography, such as country, city, language etc. Depending upon whether you are targeting a specific geographic area, or a type of place based upon weather, languages spoken etc, this type of segmentation will help you to go beyond simple demographics and be more precise in the people you are targeting.

However, because it is grouping of people by geography alone, it is assuming that all those in a group will be similar. As we all know, although there are zones in cities and countries where inhabitants are similar – many cities have an area called China Town for example – it is in my opinion dangerous to think that they will all behave and purchase in the same way. That’s why the next level of segmentation is more powerful.

Behavioural: At this level of segmentation, we are looking more at how customers behave, rather than simply who they are or where they live. Types of behaviour we might include could be what solution they are looking for based upon the benefits of a brand, how, when and where the customers buy, or where they are in terms of lifecycle or engagement with a brand.

With this segmentation, we are now grouping customers by what they do, so we at least know that they are behaving in a similar way. However, it is assuming that they behave for the same reasons, something of which we can’t be sure. That’s why the next level of segmentation provides the ultimate and most actionable clustering of customers.

Psychographics: This is amongst the most sophisticated and complex segmentations you can run. But going this deep into your understanding of your customers will ensure a competitively strong position for your brand. Included here are grouping category users by values, attitudes and opinions, interests, personality or lifestyle. I think it is very clear in looking at this list, how your segmentation using one or more of these criteria would produce the most detailed and in-depth understanding of your target customers.

Once you’ve run your segmentation and chosen the most relevant and profitable target group (I’ll speak more about that in a moment), you still need to do more. You see segmentation alone is insufficient for successful growth. As soon as you know who you are targeting, you need to then get as close as you can to your target customers, in order to understand them as deeply as possible. This should be done through regular listening and observation.

The MIDAS touch

Whatever method you use for segmenting and choosing your target customers, the results of your exercise of customer grouping needs to meet the following five conditions, known collectively as the MIDAS touch.

Measurable: The individual groups need to be clearly defined and quantifiable using KPI’s such as size, market share, value share.

Identifiable: Each segment must have a distinct profile and each customer must be attributed to only one segment.

Definable: Every cluster must be easy to describe and share with others so that you have mutual understanding of each of them.

Actionable: The groups must be easy to identify, in order to be able to target your actions and communications to them.

Substantial: The chosen segment must be financially viable to target, which means that it should, in general, be stable or growing, and durable over the long term.

All good segmentations or clusterings will fulfil all five of these key conditions, or at least they did until recently. Today the last condition is being adapted thanks to personalisation. It is more important to assess whether or not it is sustainable rather than substantial. Which term is more relevant in your own industry?

Even with this change, it is still easy for you to evaluate your segmentation, to ensure it is both valid and robust. If it does not meet these five conditions, then you will struggle to activate it and target your actions to your chosen group of customers.

As already mentioned, understanding your target as completely as possible is vital to the success of your business. I would, therefore, suggest that you review your own segmentation and decide how it can be improved. (There’s always room for improvement, isn’t there?)

This may mean simply completing the information you have on each segment. Or it may mean running a whole new segmentation exercise. However, it is definitely worth getting your segmentation and target customer choice right. After all, they form the very foundation of your brands’ customer-centricity.

A solution for those with few resources

If you do not have the time, money, or expertise to run a detailed segmentation study, you can still make an informed decision based on simple criteria. These could be gathered by mere observation, an analysis of who your purchasers are, or a review of contacts from your customer services group – taking into account that these may be biassed.

Once you have identified the different types of users you are attracting, you can then decide which is the most important group for you to target. You can do this by simply choosing the largest group, but as already mentioned large doesn’t always equate to most profitable. For this reason, I suggest using what is often referred to as the Boston Matrix. This analysis was first developed in the 70’s by the Boston Consulting Group. At the time, the matrix was created to help corporations analyse their business units and was based on market growth and relative market share.

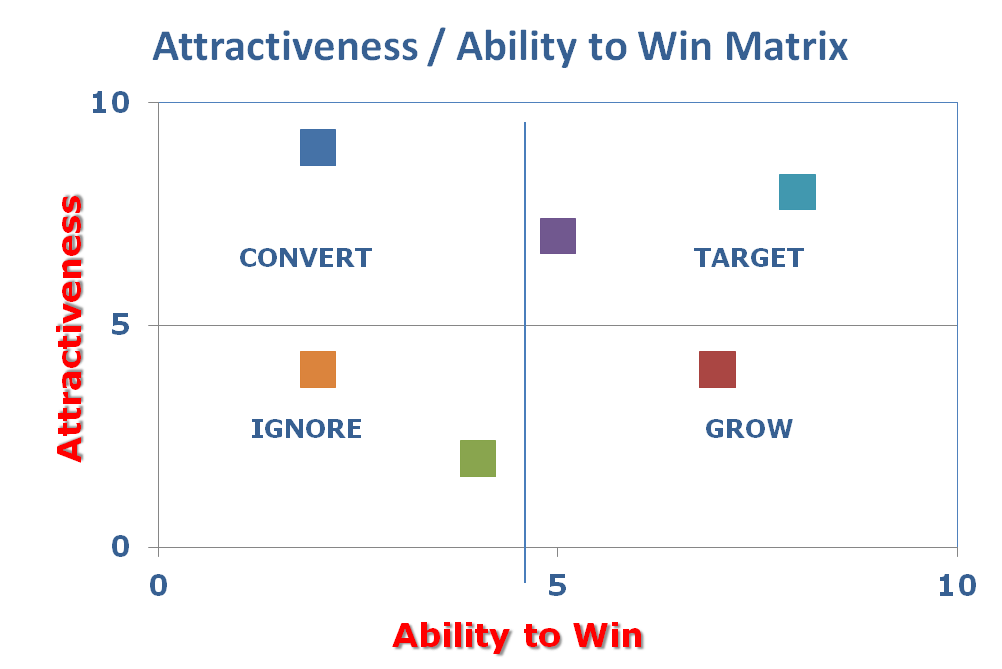

Today this scatter plot is created using various elements to make up the two axes (see example below). While the criteria you use for each axis can vary, this simple analysis has the advantage of being able to be further refined over time, as you get more information.

Choosing the criteria for the axes

The two axes you specify for the Boston Matrix can be as simple or as complex as you like. Obviously, the more criteria you use, the more accurate your analysis is likely to be. Examples of the criteria you can use include:

Attractiveness: Segment size, segment growth rate, segment value, competitive environment, profitability, industry structure, distribution, pricing, environment, seasonality, how well the group fits the company or brand – or vice versa.

Ability to win: market share, differentiation, brand strength, distribution strength, company profitability, customer appeal, customer loyalty, your media mix, your reputation, your production skills, management strength.

You can use any or all of the above suggestions for creating the two axes. If you use more than one criteria per axis, you must decide whether to average or weight them.

C3Centricity provides an automated tool for calculating the two axes and then positioning segments on them. This is made available to all participants of the Customer Centricity Catalyst Classes, which you can learn more about here.

Choosing the actions to take on each segment

Once you have positioned the different segments or groups of customers on the axes, you will easily see what needs to be done for each group:

Once you have positioned the different segments or groups of customers on the axes, you will easily see what needs to be done for each group:

Target: these are your core customers as they are both attractive to the business and easy for the company’s product or service to attract them. Therefore, they need to be protected from possible attacks by the competition.

Convert: these customers can be attracted to your product or service but your ability to win them is currently low. To win these customers you probably need to consider improving one of the elements of the mix in order to attract them.

Grow: your product or service can easily win these groups but perhaps they are not as profitable as you would like. This might change, so it is important to review them from time-to-time or develop a different strategy to attract them.

Ignore: many organisations struggle to make the decision NOT to go after a group of category customers. But if you have neither the product / service nor the segment conditions that would be profitable for you, why spend time, money and energy going after them?

This simple analysis can be made as sophisticated as you like through your choice of criteria for the axes. That is why despite being over fifty years old, it continues to be used by many organisations for their brands.

Conclusions and next steps

All businesses want to sell more. They also want as many customers as possible. And do all this while growing their profitability. However, as we have seen, trying to sell to everyone is unlikely to meet with the success you hoped. But now you have the solution.

Choosing the right group of customers to attract with your product or service is the essential first step. But so is then doing everything you can to understand your chosen segment as deeply as possible. Truly customer centric organisations excel at doing both; do you?

Need help in segmenting, identifying or understanding your target customers? Let us help you catalyse your customer-centricity. Contact us here or check out our training offers here.

C3Centricity used an image from Denyse’s book “Winning Customer Centricity”

This post is regularly updated from the original version first published on C3Centricity in 2013.